Get a quote on Business Interruption Insurance

If your IT company has offices and relies on computers and other technology to operate, it’s important to consider whether you would be able to continue doing business if your property were damaged or destroyed. Companies commonly purchase commercial property insurance to cover the value of their property, but in some cases, the loss of property would also severely slow down or entirely prevent work from taking place. This is where Business Interruption Insurance can help.

What is Business Interruption Insurance?

Business Interruption Insurance, commonly known as business income insurance, can cover business losses if you must temporarily close your business due to property that is damaged or destroyed by a covered peril. Business Interruption Insurance is designed to complement your commercial property insurance policy and covers the same perils. This coverage is not available as a standalone policy, but it is typically added to a commercial property insurance policy or business owner’s policy.

If you need to stop or reduce your business operations because of a covered cause of loss, your insurer will reimburse your business for its lost or reduced income. Coverage includes the business’s net profits plus normal operating expenses such as rent, employee salaries, and taxes.

Example:

- An electrical fire breaks out in your web hosting company’s offices. The fire causes significant damage to the building as well as destroying key infrastructure and servers that are necessary for your work. It takes you three months to get your business back up and running again. Your insurer would reimburse you for lost income and operating expenses during those three months.

Who needs Business Interruption Insurance?

Not every IT business needs Business Interruption Insurance. For example, a web development or IT consulting firm may be able to operate normally even if their physical business property is damaged. In today’s connected business environment, many companies are able to continue operating in remote environments, with little impact on everyday operations. IT businesses should consider purchasing Business Interruption Insurance if they:

- Operate from and depend on a commercial or retail location

- Depend on costly, difficult to replace equipment to run their business

- Are exposed to an elevated risk of property damage

What does Business Interruption Insurance cover?

Business Interruption Insurance reimburses you for lost profits and operating expenses if your company is unable to operate because of physical damage to your property by a covered peril. It will pay for the net income you lose while your business is closed, as well as normal operating expenses, including rent or mortgage payments, loan payments, taxes, and employee salaries. It can also pay for extra expenses that you incur as a direct result of the property loss with the addition of optional extra expense coverage.

Example:

- A leaky fire sprinkler system floods your office, damaging computers, servers, and flooring. Your company must vacate the premises while repairs are made. Your insurer would reimburse you for lost income, rent, and other operating expenses until the damaged property has been repaired or replaced.

Extra Expense Coverage

Business Interruption Insurance policies typically come in two standard forms: with extra expense coverage or without. Extra expense coverage pays for additional expenses you incur in order to continue operating your business, either at your original location or a temporary one. If property damage or destruction threatens to close your business, it’s sometimes possible to minimize or avoid closure by taking measures such as moving to a temporary location or leasing replacement equipment. Extra expense coverage can help keep your company running by paying for moving costs, rent for a temporary location, and rental equipment. Unlike other aspects of Business Interruption Insurance, this coverage often does not have a waiting period before you can be compensated, since it may be necessary to take immediate action to protect your property from further damage.

Example:

- Heavy winds blow a tree onto the roof of your web hosting company, damaging it. Your company’s servers can’t remain safely in the office while the roof is being repaired. To protect your servers, you move them to a different location. The extra expense coverage portion of your Business Interruption Insurance would pay for the cost of relocating the servers and renting space to keep them in.

Period of Restoration

The period of restoration is the period of time during which your insurer will cover your operating expenses and lost income while you rebuild, complete repairs, or move into a new permanent location. The period of restoration typically starts 72 hours after the loss occurred and ends when the necessary repairs or replacement of damaged property has been completed. The period of restoration usually has a maximum length of 12 months, but it can be extended by endorsement. As long as the loss occurred while the insurance policy is active, your insurer will continue to pay you for the entire period of restoration, even if the policy expires before the period of restoration ends.

Example:

- A fire breaks out at your computer repair store in February 2019. It takes you four months to complete repairs, and you’re able to resume business in June 2019. Your Business Interruption Insurance policy was active from March 2018 to March 2019. Because the loss occurred while the policy was active, your insurance will continue to compensate you for the full period of restoration, even though the policy ended before your business resumed operations.

Waiting Period

It’s important to be aware that Business Interruption Insurance policies usually require a waiting period before compensation begins. The waiting period is commonly 72 hours, but it may vary depending on the insurer. You will not be compensated for income lost during the waiting period.

What additional Business Interruption Insurance coverage is available?

In addition to physical property damage, Business Interruption Insurance policies may include additional coverages for other risks that could interrupt your business operations. Additional coverage options include:

Interruption of Computer Operations

Interruption of computer operations is an additional coverage that will protect you if you are unable to do business because of destruction or corruption of electronic data. Damage must be caused by a covered cause of loss. Computer viruses or malicious code that destroys or damages computer systems or data are covered, but damage caused by your employees or anyone you hire to work on your computer systems is not covered. This coverage typically has a low limit of insurance.

Extended Business Income Coverage

Extended business income coverage can help pay the difference in income when your business has reopened but has not yet returned to its previous level of income. Clients may not immediately realize that a company has reopened, and it may take some time before your company returns to its previous sales numbers. Extended business income coverage will compensate you for lost profits until you’re able to return to your previous income level. Coverage begins when your business reopens and continues until either your income has recovered or you reach the end of the term specified in the policy. Longer terms result in higher premiums.

New Buildings and Alterations

Business Interruption Insurance will cover business income lost as a result of covered physical damage to new buildings that are not yet in use, under construction, or undergoing alterations, if the damage delays the date when your business would otherwise have been able to begin operation. The period of restoration for this coverage begins on the date the company would have been able to begin operating if the property damage hadn’t occurred.

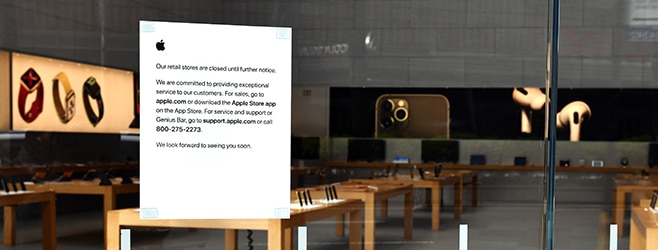

Interruption by Civil Authority

Your insurer will compensate you for lost income if the government prohibits you from accessing your business due to physical damage of nearby properties. This coverage typically begins after a waiting period and lasts for a specified period of time, often three weeks.

What doesn’t Business Interruption Insurance cover?

Business Interruption Insurance is designed to protect you if an unexpected disaster affects your ability to do business. It doesn’t cover lost income resulting from economic changes or a company’s business decisions. Causes of lost income that would not be covered include:

- Business interruptions caused by viruses or disease outbreaks

- Reduced income due to damaged reputation

- Weather conditions that cause the business to close but do not cause property damage

- Reduced profits due to economic conditions

- Losses caused by poor company management

Business Income Insurance Pricing

Business Income Insurance is not sold on a standalone basis but can be added to your commercial property insurance policy or bundled with a business owner’s policy. In order to determine pricing for your property policy, insurers will take a look at the risk of loss for your business. Part of this calculation will involve assigning a commercial property insurance rating, which is specific to the building or property you’re looking to insure. The higher risk your business is rated, the higher the premiums will be.

In order to get an accurate estimate on pricing, it’s best to get a quote from a reputable insurance company. Below we’ve highlighted a few of our trusted partners who offer property policies:

| Provider | Business Income | Commercial Property | Business Owner's Policy |

|---|---|---|---|

| CoverageSmith | ?? | ?? | ?? |

| CoverWallet | ?? | ?? | ?? |

| Thimble | ?? | ?? | ?? |

Final Word

If your IT business is unable to operate after a disaster, it could have a devastating effect on your company. Many companies in this situation are forced into bankruptcy. It’s a good idea to consider Business Interruption Insurance to provide financial protection if your business is forced to temporarily close. If your IT company relies on its location or property such as computers to do work, a Business Interruption Insurance policy can reassure you and your clients that you will be able to return to work if crucial property is damaged.