The average cost of condo insurance in the U.S. is $506 per year or $42 per month. It is vital for condo owners to financially protect themselves in the event of a serious injury, theft, vandalism, fire, or significant property damage to the condo unit. Without condo insurance, also known as HO-6 insurance, owners must pay for these costs out-of-pocket, which can potentially reach life-altering amounts.

Average Cost of Condo Insurance by State

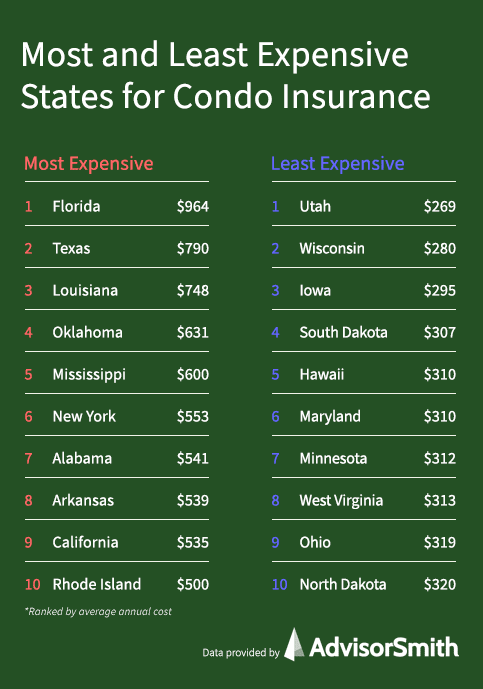

Nationally, the average annual cost of condo insurance is $506. However, this amount may differ significantly depending on your location. The range of average annual costs is as low as $269 in Utah to as high as $964 in Florida.

| State | Average Monthly Cost | Average Annual Cost | Difference from National Average |

|---|---|---|---|

| Alabama | $45 | $541 | 7% |

| Alaska | $33 | $396 | -22% |

| Arizona | $33 | $400 | -21% |

| Arkansas | $45 | $539 | 7% |

| California | $45 | $535 | 6% |

| Colorado | $35 | $417 | -18% |

| Connecticut | $33 | $399 | -21% |

| Delaware | $36 | $431 | -15% |

| District of Columbia | $31 | $369 | -27% |

| Florida | $80 | $964 | 91% |

| Georgia | $41 | $493 | -3% |

| Hawaii | $26 | $310 | -39% |

| Idaho | $35 | $420 | -17% |

| Illinois | $33 | $398 | -21% |

| Indiana | $30 | $354 | -30% |

| Iowa | $25 | $295 | -42% |

| Kansas | $37 | $439 | -13% |

| Kentucky | $33 | $390 | -23% |

| Louisiana | $62 | $748 | 48% |

| Maine | $29 | $342 | -32% |

| Maryland | $26 | $310 | -39% |

| Massachusetts | $37 | $444 | -12% |

| Michigan | $31 | $369 | -27% |

| Minnesota | $26 | $312 | -38% |

| Mississippi | $50 | $600 | 19% |

| Missouri | $35 | $416 | -18% |

| Montana | $32 | $382 | -25% |

| Nebraska | $30 | $355 | -30% |

| Nevada | $35 | $424 | -16% |

| New Hampshire | $28 | $332 | -34% |

| New Jersey | $38 | $450 | -11% |

| New Mexico | $33 | $397 | -22% |

| New York | $46 | $553 | 9% |

| North Carolina | $38 | $456 | -10% |

| North Dakota | $27 | $320 | -37% |

| Ohio | $27 | $319 | -37% |

| Oklahoma | $53 | $631 | 25% |

| Oregon | $30 | $364 | -28% |

| Pennsylvania | $32 | $385 | -24% |

| Rhode Island | $42 | $500 | -1% |

| South Carolina | $42 | $500 | -1% |

| South Dakota | $26 | $307 | -39% |

| Tennessee | $39 | $473 | -7% |

| Texas | $66 | $790 | 56% |

| Utah | $22 | $269 | -47% |

| Vermont | $29 | $345 | -32% |

| Virginia | $29 | $352 | -30% |

| Washington | $31 | $374 | -26% |

| West Virginia | $26 | $313 | -38% |

| Wisconsin | $23 | $280 | -45% |

| Wyoming | $32 | $379 | -25% |

There are a number of factors that may determine the cost of condo insurance, including your condo’s location, how densely populated the area is, exposure to natural disasters, and even exposure to criminal activity.

Most Expensive States for Condo Insurance

States in the South were among the most expensive places for condo insurance. Eleven of the top 15 most expensive states were all southern states, and states in the Southeast were particularly prevalent, taking up nine of the top 15 spots.

The top five most expensive states for condo insurance are:

- Florida, with an average annual cost of $964

- Texas, with an average annual cost of $790

- Louisiana, with an average annual cost of $748

- Oklahoma, with an average annual cost of $631

- Mississippi, with an average annual cost of $600

There are certainly many factors taken into account when determining condo insurance, but the location of these particular states seems to play a major role. After all, southern states are prone to severe weather events, including hurricanes and tornados. In fact, eight of the top 10 costliest natural catastrophes in the U.S. were hurricanes, all impacting southern states.

Least Expensive States for Condo Insurance

With far less exposure to natural disasters, the least expensive states for condo insurance are almost all located in the northern region of the United States. The one exception is Hawaii. Many of these states are among the least populated in the country, which may also help to explain their lower condo insurance rate.

The top five least expensive states for condo insurance are:

- Utah, with an average annual cost of $269

- Wisconsin, with an average annual cost of $280

- Iowa, with an average annual cost of $295

- South Dakota, with an average annual cost of $307

- Hawaii, with an average annual cost of $310

With less populated cities and fewer chances of a natural disaster, it’s no surprise that these particular inland states offer a lower rate for condo insurance.

How does coverage level affect condo insurance costs?

Although the cost of your condo insurance is largely determined by your location, another major factor is your coverage limit, which is the highest amount your insurer will pay for a claim. As with most insurance policies, a higher coverage limit often means a higher average cost. This can equate to a significant change in your premium costs. For instance, condo policies with a coverage limit of less than $14,000 had an average annual cost of $373, while policies with a coverage limit of over $100,000 or more had an average annual cost of $857.

| Coverage Limit | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| $13,999 and under | $31 | $373 |

| $14,000 to $19,999 | $31 | $366 |

| $20,000 to $25,999 | $37 | $445 |

| $26,000 to $31,999 | $34 | $407 |

| $32,000 to $37,999 | $34 | $403 |

| $38,000 to $43,999 | $36 | $434 |

| $44,000 to $49,999 | $34 | $413 |

| $50,000 to $74,999 | $39 | $473 |

| $75,000 to $99,999 | $45 | $534 |

| $100,000 and over | $71 | $857 |

| National Average | $42 | $506 |

What’s covered by condo insurance and what’s not?

Condo insurance financially protects you, your condo unit, and your belongings. A standard condo insurance policy typically includes the following forms of coverage:

- Building property protection. This coverage protects the interior of your business property if there is any damage or loss due to a covered peril such as fire, windstorm, theft, or vandalism. This coverage includes your condo’s floors, walls, and permanent fixtures within your unit such as built-in bookcases, cabinets, and sinks. If this building property is damaged or destroyed by a covered peril, your condo insurance policy will pay up to the coverage limit to assist with replacing or repairing the property.

- Personal property coverage. The personal property portion of your coverage includes the items within your condo that are not fixtures in your home. This includes electronics, furniture, clothes, and portable appliances. Your condo insurance policy will provide the finances up to the policy limit to repair or replace these items if they are stolen or damaged in a covered claim.

- Liability coverage. You may be held liable for instances of third-party bodily injury or property damage that occurs within your condo. For instance, if a guest at your condo is accidentally injured and you are at fault, your condo insurance can cover the medical fees associated with the injury and provide funds for legal fees to defend yourself.

- Medical coverage. Even if a guest is injured within your condo and you are not at fault, your condo insurance can financially assist with the medical fees associated with this injury.

- Loss of use coverage. If a covered event forces you to temporarily live outside of your condo, the increased living expenses will be covered. For instance, if a fire makes your condo uninhabitable and you are ordered to evacuate, your condo insurance policy can provide the funds necessary for you to temporarily relocate and maintain your usual standard of living. As such, this coverage is sometimes called living expense coverage.

- Loss assessment coverage. Your policy may also include loss assessment coverage. If your condo association issues a special assessment, this coverage assists you in covering your share. If a covered peril damages a common area such as the outside of the building, this coverage may help pay for your part of the bill.

- Exclusions. Certain perils—such as earthquakes, flooding, pest infestations, and general wear and tear—are typically not covered in a standard condo insurance policy. To cover this gap, it is important to consider purchasing an endorsement or separate coverage—especially if you live in an at-risk area.

What determines the cost of condo insurance?

There are a number of factors that determine the final cost of your condo insurance. To get the most accurate estimate, we recommend taking some time to analyze the amount of coverage you need and gather quotes from various insurers. The following are some notable factors that may play a role in your condo insurance price:

- Your deductible. As with most insurance policies, selecting a higher deductible will mean a lower premium. Your deductible is the amount you agree to pay out-of-pocket before your insurance benefits provide coverage.

- Your claims history. The number of claims you’ve made in the past, your insurance and credit score, and even a history of continued coverage can all affect the price of your condo insurance. After all, if your history shows that you have a tendency to file claims, your insurer may deduce that you’re likely to file a claim in the future.

- Your location. As evidenced from the above studies, your location is a major determining factor for the cost of your condo insurance. Your proximity to the coast and your exposure to natural disasters all increase your risk. In turn, your premium will be increased as well.

- Your condo’s features. If you have an aging condo that requires a number of fixes, the condo naturally holds more risk and that will be reflected in your condo insurance costs. Consider maintaining and renovating your condo to decrease your risk and lower your rates.

- Your HOA’s policy. Your homeowners association (HOA) master policy may be bare walls coverage, single entity coverage, or all-in coverage. With varying conditions, the cost of your condo insurance may be heavily determined by which type of HOA master policy you have. A bare walls policy only covers the structures of your unit and common areas of the condo. While reviewing costs with this type of HOA master policy, remember that you may have to purchase endorsements or additional policies for full protection. A single entity coverage policy covers everything in a bare walls policy plus your condo’s floors, walls, and permanent fixtures within your unit. Finally, an all-in policy covers most aspects of your condo building except for personal property like clothes, furniture, and electronics.

Methodology

AdvisorSmith used data published by the National Association of Insurance Commissioners (NAIC) on countrywide and state-specific premium and exposure information for condo/co-op (HO-6) insurance policies. This data was published in the 2020 NAIC Dwelling Fire, Homeowners Owner Occupied, and Homeowners Tenant and Condominium/Cooperative Unit Owner’s Insurance Report, which analyzed data from 2018.

The data for condo/co-op policies that was collected spanned over 23 million house-years, with house-year being defined as policy coverage on a dwelling for 12 months. Data was collected from all 50 states and the District of Columbia.