Get a quote on Product Insurance

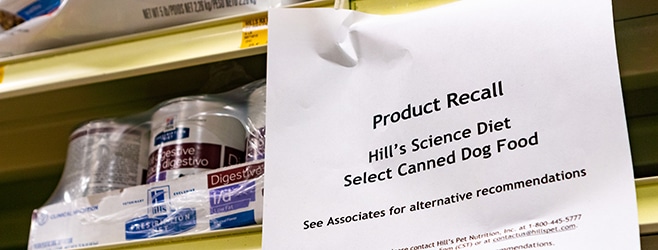

When your product poses a threat to the safety of a consumer or is simply prone to error, you will be encouraged to perform a product recall. As government and regulatory body guidelines for product safety become more and more stringent, product recalls have become an everyday occurrence. If your business is faced with recalling a product, the damage to both your reputation and bottom line can be profound—this is where Product Recall Insurance comes in.

What is Product Recall Insurance?

Product Recall Insurance protects your business from the first-party financial costs of performing a voluntary or involuntary product recall. If your company produces a product that is found to be potentially dangerous to consumers, you may be forced to perform a recall by the relevant regulatory body, or you may decide to issue a voluntary recall.

The direct costs associated with a product recall can be devastating for any business, and the purpose of Product Recall Insurance is to provide coverage for these expenses.

Why is Product Recall Insurance important?

Recalling a product is not always as simple as cutting a few checks to disgruntled customers. In addition to offering a refund, you may also have to:

- Pay to ship, store, dispose of, and replace faulty merchandise

- Implement specialized testing or handling in order to diagnose contaminated products or defects

- Hire additional staff or pay overtime in order to execute the recall

- Publicize the recall through advertisements on TV or in print

- Devise a new PR campaign to restore your brand’s image

Product Recall Insurance can cover recall costs and more, offering financial protection from the unexpected burden of a product recall. This type of insurance is especially necessary for businesses that work with food, electronics, children’s toys, or any type of merchandise that could cause bodily harm or property damage. And for smaller businesses that may not have the finances to address a large recall event, a Product Recall policy could mean the difference between staying in business and filing for bankruptcy.

Example:

- A toy company sells a doll that is found to have a dangerous wire poking out of its arm socket. The U.S. Consumer Protection Safety Commission (CPSC) orders the company to recall the product. Thousands of dolls are spread throughout the United States, and the aforementioned company is forced to pay for their storage and shipping costs.

Do I need Product Recall Insurance?

If you run a business where an error in your product may cause harm to a consumer, then it may be wise to purchase Product Recall Insurance. If you think that as a smaller company you are less liable to product recall risk exposures, keep in mind that one-third of product recalls are reported by businesses with five or fewer employees. Types of companies that benefit the most from Product Recall Coverage include:

- Children’s toy manufacturers. These items might be placed in children’s mouths, meaning that problems like a high concentration of lead paint can result in illness.

- Drug companies. Faulty pharmaceuticals can easily cause fatalities.

- Food manufacturers. Improperly managed foods can become susceptible to accidental contamination with bacteria.

- Auto parts manufacturers. The automobile industry is notorious for its history of expensive recalls.

- Electronics manufacturers. Malfunctioning electronics can cause fires and physical harm.

Product recalls more common than ever

Product recalls are on the rise, with the introduction of stronger laws from regulatory bodies like the FDA, USDA, and Consumer Products Safety Commission (CPSC). Some of the reasons for these new laws include:

- Technological advancements. It’s now easier to detect manufacturing errors.

- Global nature of trade. Component parts from foreign countries may not be made with the same quality control or regulations as their American counterparts.

- Faster communication. Innovations like the internet and cell phones make it more convenient for individuals to monitor and report errors.

What does Product Recall Insurance cover?

Product Recall Insurance generally covers first-party losses that result from a product recall, including the costs of withdrawing a product from market, loss of sales, product loss, disposal costs of defective products, labor costs to manage a recall, product testing, and more.

Coverage does vary widely for Product Recall Insurance, as the insurance market for this type of coverage is highly specialized. Depending on the type of product you sell and the industry you’re in, Product Recall Insurance policies may look very different.

Although product policies can be highly variable, the following are common coverage areas for Product Recall Insurance:

- Replacement, repair, or reimbursement. As part of your product recall, you will likely need to compensate customers who purchased the product with product defects, either through replacement or repair of the product or monetary reimbursement.

- Shipping and storing defective products. This includes the costs of retrieving products from customers, distributors, and retailers, as well as the costs of storing the product.

- Disposing of defective products. Some products may require unusual disposal methods like incineration.

- Hiring extra workers or paying overtime to existing workers. You might need additional staff or extra hours from existing staff to monitor the warehouses, issue statements, and more.

- Customer notifications. This could include sending letters or making announcements on TV.

- Marketing campaigns to restore your reputation. A recall can have a negative impact even after the product is pulled. You might use advertising, special promotions, or PR consultants to help restore the public’s trust in your brand,

- Inspections from regulatory or government bodies. If your recall is involuntary and mandated by a regulatory body or the government, you will likely be subject to a number of costly investigations to ensure compliance.

- Lost profits within a set date range. You will not earn revenue on the faulty product, and your resources will be pulled from other sources of income in order to deal with the crisis. Sales of your other products may be impacted by the recall as well.

- Third-party expenses. Other companies or vendors who use your defective product as a component in their own product may experience lost income and a variety of expenses to recover from your recall.

If you sell a product that is used as an ingredient or component, it is recommended that you purchase Product Recall Insurance with coverage for third-party expenses. Conversely, if you used a faulty ingredient or component when creating your product, you may be able to cover the costs of a recall if you can prove that the other business was the source of the error. When you evaluate your suppliers, make sure that they have third-party Product Recall Insurance, or they may not be able to bear the burden of these costs, and you will not be compensated.

Example:

- A factory manufactures rhinestones that are meant to be used by other businesses to make clothing. A T-shirt company purchases their rhinestones and uses them to create a special collection of rhinestone encrusted T-shirts. There are reports that the metal from the rhinestones digs into customers’ skin, creating scratches that can become infected. The T-shirt company must recall the faulty shirts. After the bad press, they develop a reputation for being “cheap” and “unsafe.” Facing bankruptcy, the T-shirt company proves that the source of the problem is the rhinestone manufacturer. They sue the rhinestone business to cover the costs of the recall.

What are the key exclusions of Product Recall Insurance?

If you sell a product that is especially dangerous to consumers in the event of an error, you may not be eligible to buy Product Recall Insurance. The list of barred products varies by insurance carrier and policy, but can often include:

- Pet food

- Dietary supplements

- Automobiles

- Tobacco and e-cigarettes

- Drones

- Infant carriers

- E-bikes

- Drop side cribs

- Software

It’s important to note that Product Recall Insurance, like product liability insurance, is typically only triggered if the defective product can cause consumers bodily harm or property damage. Products that simply don’t work, but don’t have the potential to cause injury or damage, are not eligible for reimbursement. Both voluntary and involuntary recalls are covered through Product Recall Insurance.

Is product liability insurance the same as Product Recall Insurance?

If you have general liability or product liability insurance, you might believe that you are already covered in the event of a product recall. However, this is not the case. Liability insurance only pays out the costs associated with a customer’s lawsuit against you, typically addressing third-party bodily injury or property damage. It does not cover any of the first-party costs of recalling your product, e.g., removing your product from the market and rehabilitating your company’s reputation.

Product Recall Insurance also differs from liability insurance in that it can be activated before anyone is harmed. You do not need to be sued in order to use your Product Recall Insurance.

Example:

- A company sells canned soup and has been getting complaints about food poisoning from their “chicken noodle” variety. Four people come forward to sue the company for pain and suffering, and they win. The company is protected from the costs of the product lawsuit through their product liability insurance. However, the faulty chicken noodle soup continues to circulate on shelves throughout the Midwest. The business is forced to pay a large sum out of pocket to recall the soup and prevent new infections.

Final Word

With stronger laws in place on consumer goods, product recalls are becoming an everyday occurrence. Companies with even the highest safety protocols can make the occasional error, and the financial implications of recalling a slip-up are exceptionally high. Product Recall Insurance is a safe way to hedge your bets in a world where mistakes can and do happen.